Insurance is a contract in which an insurer indemnifies another against losses from specific contingencies or perils. It helps to protect the insured person from risks, including loss of life, limb, or property damage. Insurance can be purchased for a variety of reasons, including to protect against the loss of a home, car, or other valuable possessions. Many people purchase insurance to help cover the cost of medical bills in the event of an accident or illness. There are a variety of insurance policies available, and it is important to choose the one that best meets your needs.

What is insurance?

Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies.

Insurance protects you from having to pay out of pocket for damages or medical expenses resulting from an accident, injury, or property damage.

Without insurance, one mishap could bankrupt you.

With insurance, you can have peace of mind knowing that you're protected against the high cost of unexpected emergencies.

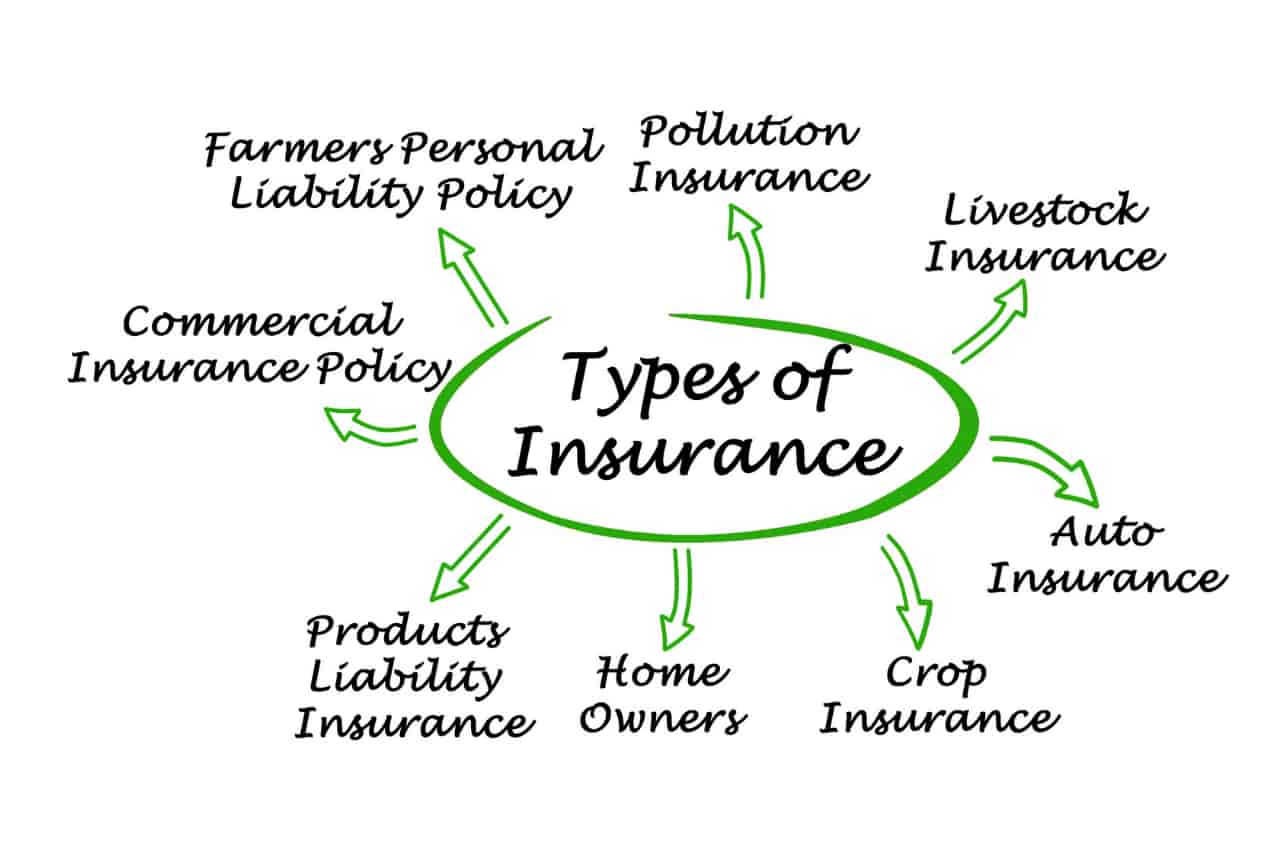

The different types of insurance

There are four types of insurance that most financial experts recommend everybody have: life, health, auto, and long-term disability. Insurance is an important way to protect yourself and your family from financial ruin in the event of an unexpected accident or illness. While no one likes to think about the possibility of bad things happening, it's always better to be safe than sorry.

Health insurance is perhaps the most important type of insurance for people to have. If you get sick or injured and need medical care, health insurance will help pay for your treatment. Without health insurance, you may be stuck with a huge medical bill that you can't afford.

Auto insurance is also important for people to have. If you get into an accident, auto insurance will help pay for the damages to your car and any injuries that you may have suffered. Again, without auto insurance, you could be on the hook for a large amount of money.

Finally, long-

Why you need insurance

Insurance plans will help you pay for medical emergencies, hospitalisation, contraction of any illnesses and treatment, and medical care required in the event of an accident. Insurance is key to you being able to focus on the important things in life, because it will ensure financial security for you and your family should anything happen to you. Businesses require special types of insurance policies that insure against specific types of risks faced by a particular business. Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have. Employer coverage is often the best coverage you can get, so take advantage of it if your company offers it. Accidents and disasters can and do happen. If you aren't flush with cash to handle them, you could face huge financial struggles and even bankruptcy. Contrary to such thoughts, no matter how healthy we are or how well we are doing financially or how good a driver we are, we all need insurance. This is

How to get insurance

Insurance is a contract (policy) in which an insurer indemnifies another against losses from specific contingencies

Four types of insurance that most financial experts recommend include life, health, auto, and long-term disability.

Key Takeaways.

Life insurance will help

Where to buy insurance.

You can buy insurance from: a licensed insurance agent; a registered insurance broker; an

Get an insurance quote in minutes from a top-rated company.

Find 24/7 support and insurance for you, your family, and business needs with the click of a button. Get a free online quote now!

The benefits of having insurance

There are many benefits of having insurance, but three of the most important benefits are: protection, peace of mind, and responsibility.

Insurance protects you and your family financially in the event of an accident, illness, or death. No one knows when something bad will happen, so it's important to have insurance in case something does go wrong. If something does happen and you don't have insurance, you will have to pay all of the costs yourself which could be devastating.

Peace of mind is another benefit of having insurance. When you have insurance, you know that you and your family are taken care of financially if something happens to you. This can give you a great sense of relief and allow you to focus on other things in life without worry.

Lastly, having insurance demonstrates responsibility. By having insurance, you are showing that you are responsible for your own well-being and that of your family. This is a positive quality that will make

Comments

Post a Comment